FinCEN Intake functionality

We've been looking into how we can help our users with the intake and handling of information related to the Corporate Transparency Act (CTA) and filing Beneficial Ownership Reports to the Financial Crimes Enforcement Network (FinCEN).

What is a Beneficial Owner Report?

As of Jan 1, 2024 this report needs to be filed with FinCEN for any (non-exempt) existing entities filed with a Secretary of State or newly created entities with a Secretary of State (e.g. LLC) - detailing who the "beneficial owners" of the entity are.

What goes into a Beneficial Owner Report?

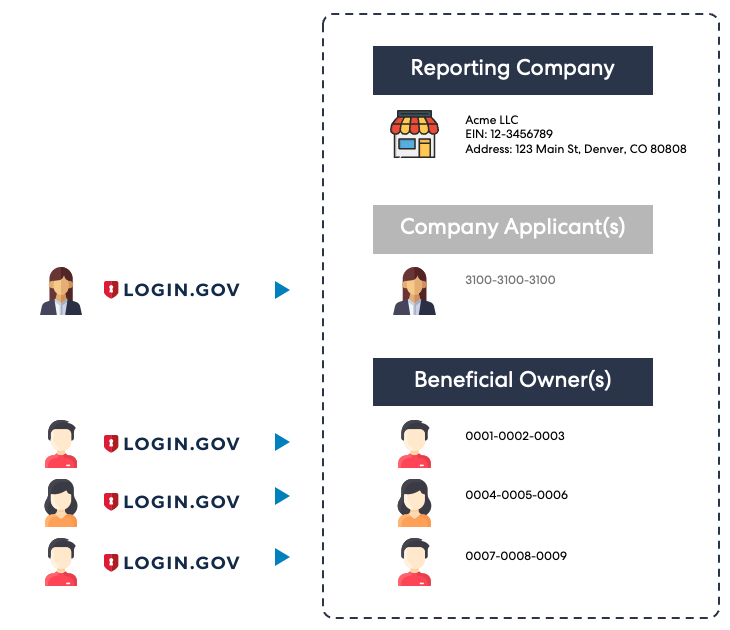

A BOI Report contains information on:

- Reporting Company - Name, Tax Identifier & Address for the Company

- Company Applicant(s) - the 1 or 2 individuals who registered the entity

- Beneficial Owner(s) - the individuals who are 'beneficial owners' of the entity

Who are Beneficial Owners?

Legal analysis and advise is required to determine the beneficial owners of an entity.

In general terms, anyone with 25% or more ownership in the entity - or with "substantial control". You can refer to FinCEN's Small Entity Compliance Guide for more information.

How to approach the filing of the report?

We have identified two overall 'approaches' in our research:

The "Full Info" Approach

This involves gathering all the information (names, addresses, scans of driver license / passport for all people involved) and filing all of that with FinCEN in one big bundle of information.

The "Personal Identifier" Approach

Here, each individual first registers their own FinCEN personal identifier using a personal login.gov account.

Then the Beneficial Owner Report will only contain the information on the reporting company and the "FinCEN Identifiers" of these individuals.

What happens when things change? How to keep information updated?

One of the requirements of the CTA is that information on Beneficial Owners needs to be kept up to date - with any updates due within 30 days of any change.

This is where the big difference shows between the two approaches listed above:

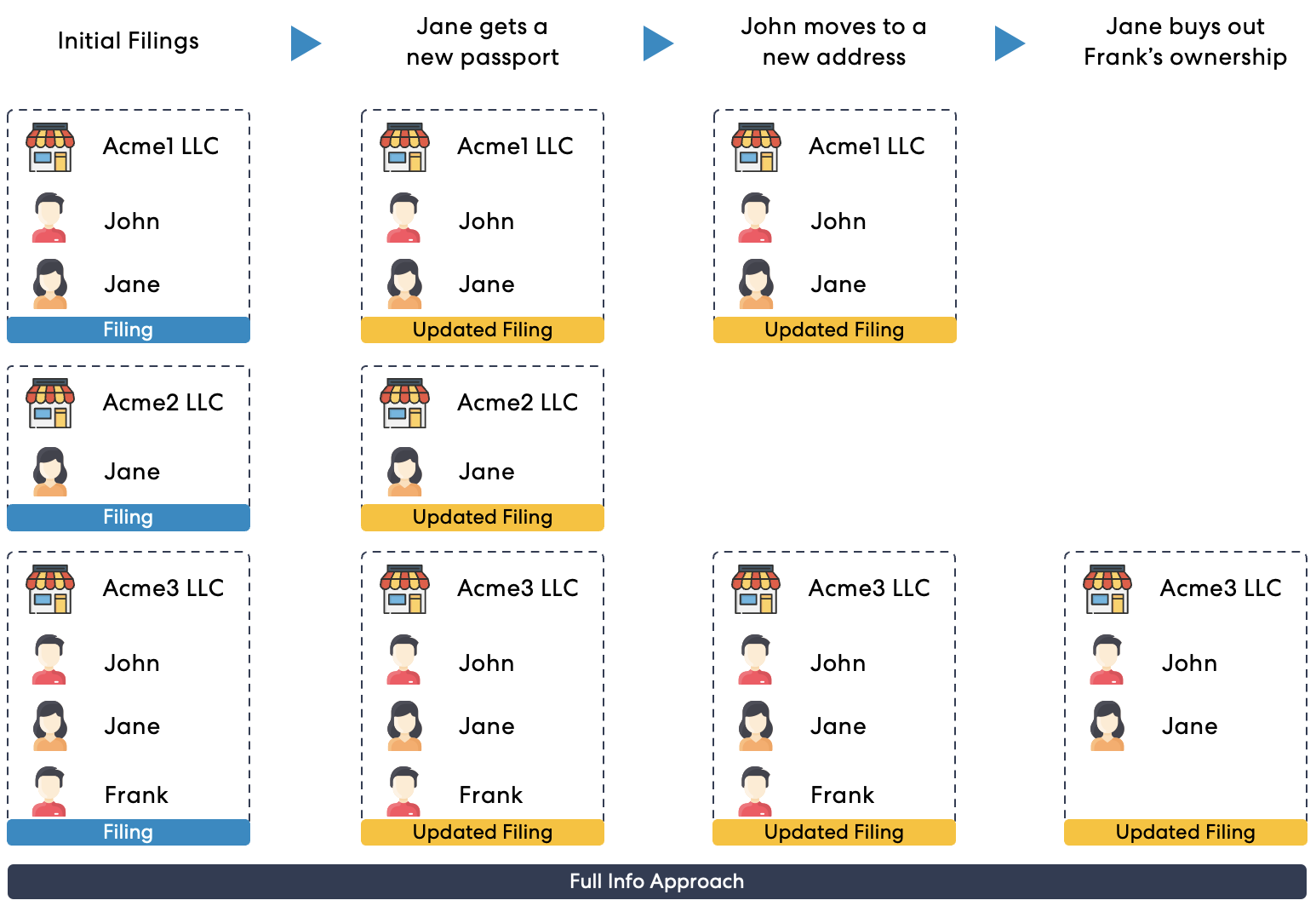

- If the "Full Info" approach was used, then ALL the information needs to be refiled in a new Beneficial Owner Information Report along with the changed info (for every entity).

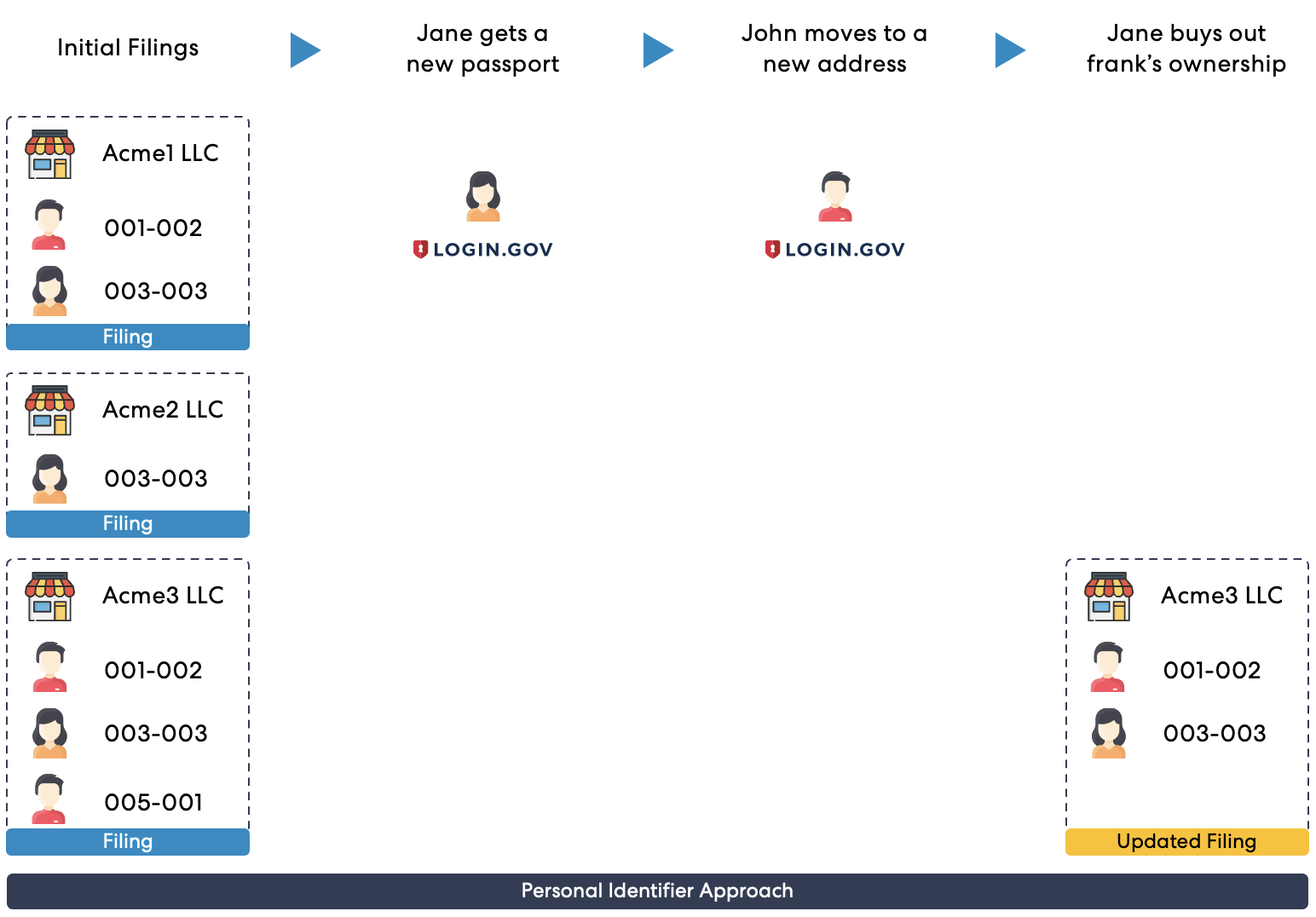

- Under the "Personal Identifier" approach the person who had a change (in their address, or if they have a new passport or driver's license) can log in to the FinCEN system with their login.gov account, and update their own personal information. No updated BOIR filings are needed at all.

Let's illustrate this with an example

Under the "Full Info" approach - a new full report including all the information needs to get filed for every single change, and for all the entities that the person is a beneficial owner of:

Whereas under the "Personal Identifier" approach - future report filings are only necessary if there are (address) changes for the reporting company, or in the list of beneficial owners. For changes in address or identifying documents of the individual the person can log into their account and change their info themselves - once.

Under this approach, updated filings are only needed to reflect changes in the list of beneficial owners of an entity.

Recommended Approach

It's one thing to file the initial report to become compliant with these regulations this year - but that's hardly the end of it. It will be necessary to keep information updated (within 30 days of any change event!) going forward.

That's why we believe that the "Personal Identifier" approach is much preferable to the "Full Info" one.

Taking an approach where the client can log in themselves and report just their own change is much simpler than the law firm keeping track of current scans of passports of ALL the beneficial owners of each entity to file an updated full report.

Filing a BOI Report using these FinCEN identifiers is very straightforward through the regular web form of the FinCEN website.

How can DecisionVault help gather the needed information?

We have add some functionality in DecisionVault to help gather the needed information from clients.

You can learn more about these components and how to use them in the following support article: How to gather information for FinCEN Beneficial Owner Filings with DecisionVault?